Empowering business decisions by harnessing the power of data

Our team consists of seasoned market experts with decades of experience in data sourcing, data processing and data management of financial instruments and transactions. We specialize in Fixed income instruments (Bonds, Loans and Private Credit), Structured products (CLOs), Funds data, M&A transactions (Corporate and Private Equity), Project finance, and Infrastructure transactions.

Data entry and processing for

– Fixed Income Instruments (Bonds and Loans)

– Structured Products (CLOs)

– Funds ( Infrastructure, Private Credit, Private Equity)

– M&A transactions

– Project and Infrastructure transactions

We also provide Excel VBA programming and Data research services.

- Excel VBA Programing

- Data Entry and Data Processing

Connect with us for a free advisory session.

We aim to provide clients with the following experiences:

- Tailored Solutions: We work with each client to create unique Data and Operational Needs

- Operational Bandwidth: We offer rapid scaling of operational teams, enabling clients to utilize internal resources efficiently

- Reliability and Consistency: Our team is led by Seasoned Market Experts giving clients confidence in our delivery

- Quick Turnaround: We utilize a mix of Automation and Manual processes to deliver Quality and Quick Turnaround

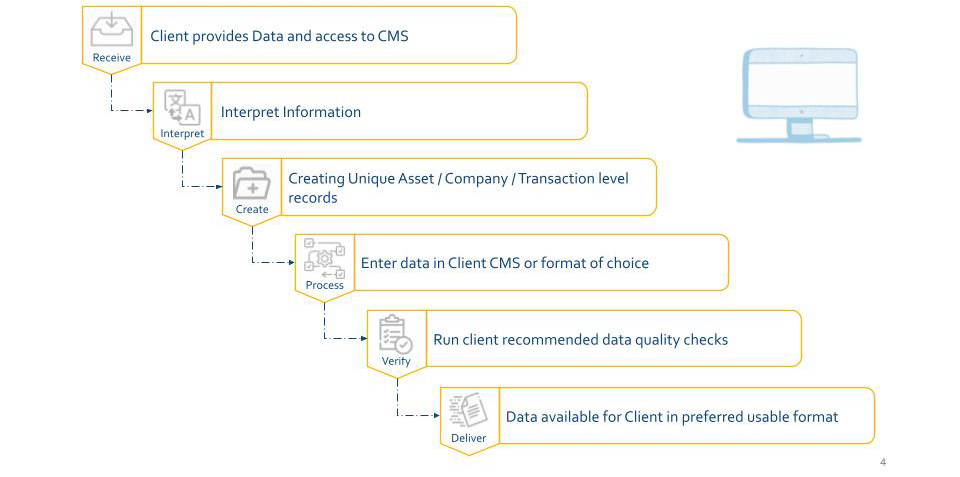

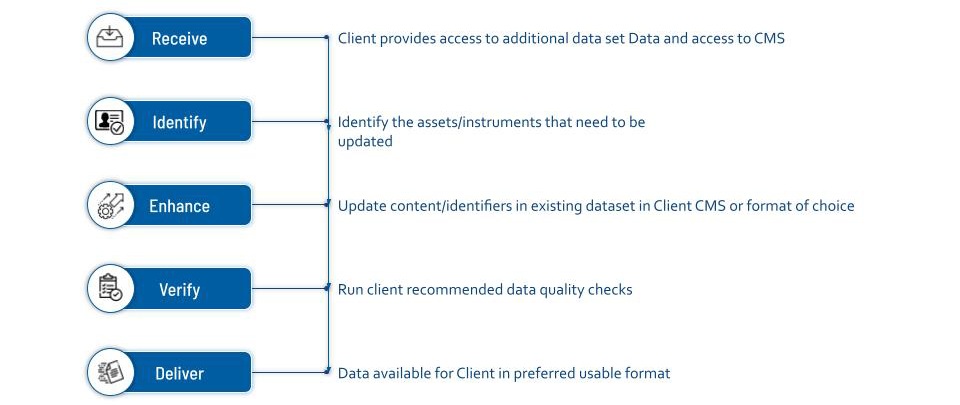

Research and Data Processing

- Receive Client provides Data and/or List of Data Sources and access to CMS

- Normalize Gathering and Normalization of Data from Multiple Sources

- Interpret Interpret Information

- Create Creating Unique Asset/Company/Transaction level records

- Process Enter data in Client CMS or format of choice

- Verify Run client recommended data quality checks

- Deliver Data available for Client in preferred usable format

Projects

- Produce Detailed Collateral Holdings from Trustee Files

- Identify Traded Assets and Prices from Trustee Files

- Map Holdings to Market Identifiers (Refinitiv’s LIN, IHS Markit’s LXID, Bloomberg ID, CUSIP and ISIN)

- Track lifecycle of Infrastructure Projects events

- Track corporate action on fixed income investments

- Assist companies in setting up company databases with identifiers

- Extracting asset level information from credit agreements/bond indenture documents