Accounting & Bookkeeping

FINANCIAL SOLUTIONS

- Business Process Outsourcing (BPO Services)

- Preparing Financial Statements (IFRS and GAAP)

- Payroll Services

- Accounts Payable Process Services

- Accounts Receivable Process Services

- Expense Management.

- Management Reporting

- Employee Fund Management & Accounting

- Fixed Assets Register

- Inventory Control Maintenance and Reconciliation

- Bank Account Reconciliations

- Sales & Purchase Order Generation

- Advising on Company Chart of Accounts

- Balance Sheet Reconciliation

- Work in process (WIP) Inventory Management

- Invoicing - Creation and Sending Invoices

- Working Capital Management

- Material Requirement Planning

- Receipts and Disbursements Management

- Forensic Accounting

- General Ledger Accounting

- Training and Support of Accounting Staff

- Oversight of the finance functions

- Digital Accounting / Assessment / Implementation

EMPOWERING THE FUTURE OF WORK THROUGH FINANCIAL OUTSOURCING

OUR DIGITAL WORK SPACE

From basic invoicing and billing to project management, our variety of use of various accounting software, tailored to each clients needs, provides an essential tool for each business’s financial data.

BOOK KEEPING

Procuring material from various vendors for onward supply to companies on commission basis. Keeping track of the materials purchased, vendor listings, payments to the vendors and tracking receivable of the invoices issued including monthly sales taxes payments to the government.

Developing a comprehensive accounting process/system to maintain complete vendor listings, product quantity and price, profit margins, invoice tracking system, monthly sales tax payments, quarterly review of the prices with profit margins, bank reconciliations together with cost management and monthly profit and loss statements.

Implementing our four accounting principals of Authentication, Authorisation, Accounting and Accuracy. Applying proper internal controls for eliminated fraud, increasing monthly profits with cost effective monitoring, reducing bad debts with receivable ageing analysis and tracking the turn around time for revenue collection and effectively expanding the business of the Client.

FINANCIAL STATEMENTS

Financial reporting and analysis involves the preparation of different kinds of reports and the analysis of the data to determine the financial health of a company.

In the ever-growing complex world, our reporting service department is equipped in preparing set of reports (under both IFRS and GAAP standards) as and when required to give the Company an accurate picture of the financial position of the organization.

Our Team has prepared the financial statements for the following entities:

- Employees benefit funds

- Multinationals

- Partnership

- NGOs (Non-Government Organizations)

- NPOs (Non-Profit Organizations)

- Sole proprietorships

- Trusts

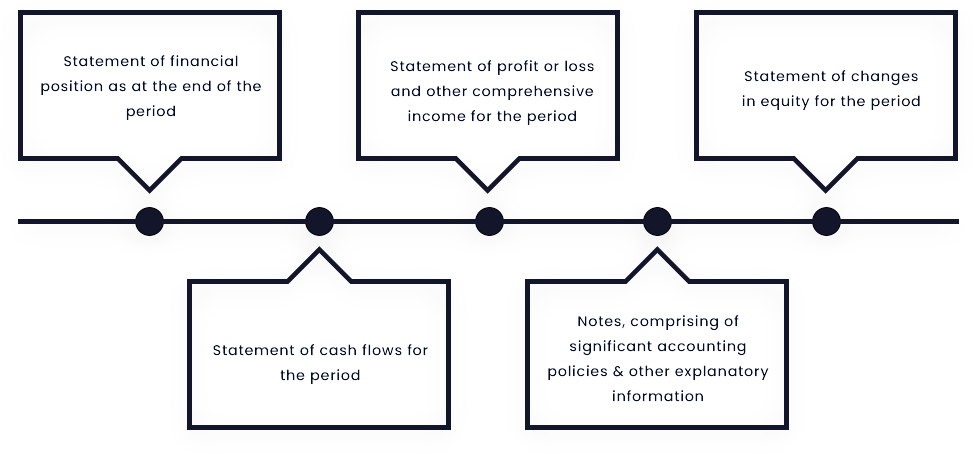

FINANCIAL STATEMENTS

Set of accounting standards developed by the IASB which is the global standard for preparation of the financial statements.

Essential of Financial Statements

CASH MANAGEMENT

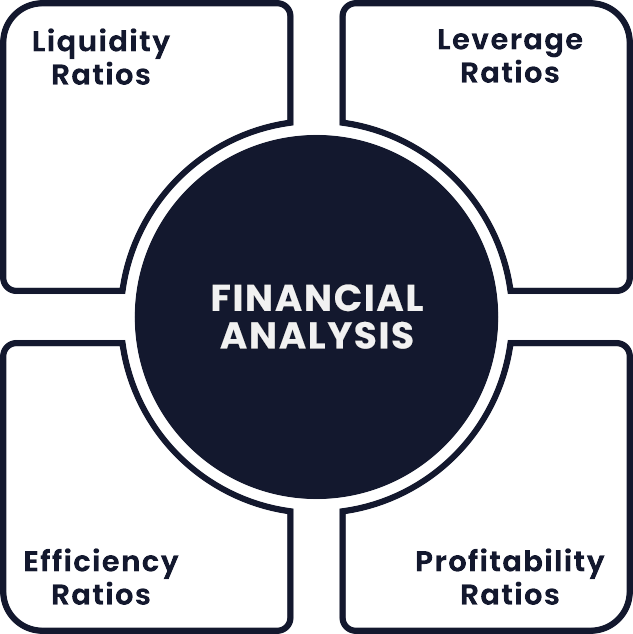

FINANCIAL ANALYSIS

Evaluating the Company’s financial performance by examining its financial statements and other significant data. Financial analysis helps investors, creditors, and other stakeholders make informed decisions about a Company’s financial health and future prospects.

Our team is specialized in performing the financial analysis of any business adhering to the following procedures:

1. Collecting financial data: Gathering information from financial statements, company reports, and other documents.

2. Analyzing financial data: Gathering information from financial statements, company reports, and other documents.

3. Interpreting results: Comparing the financial ratios to industry benchmarks or historical trends to interpret the company’s financial performance.

4. Making recommendations: Based on the results of the analysis, recommendations to the investors, creditors, or other stakeholders about the company’s financial health and future prospects.

FINANCIAL ANALYSIS

Evaluating the Company’s financial performance by examining its financial statements and other significant data. Financial analysis helps investors, creditors, and other stakeholders make informed decisions about a Company’s financial health and future prospects.

Our team is specialized in performing the financial analysis of any business adhering to the following procedures:

1. Collecting financial data: Gathering information from financial statements, company reports, and other documents.

2. Analyzing financial data: Gathering information from financial statements, company reports, and other documents.

3. Interpreting results: Comparing the financial ratios to industry benchmarks or historical trends to interpret the company’s financial performance.

4. Making recommendations: Based on the results of the analysis, recommendations to the investors, creditors, or other stakeholders about the company’s financial health and future prospects.